Law •

March 21, 2025

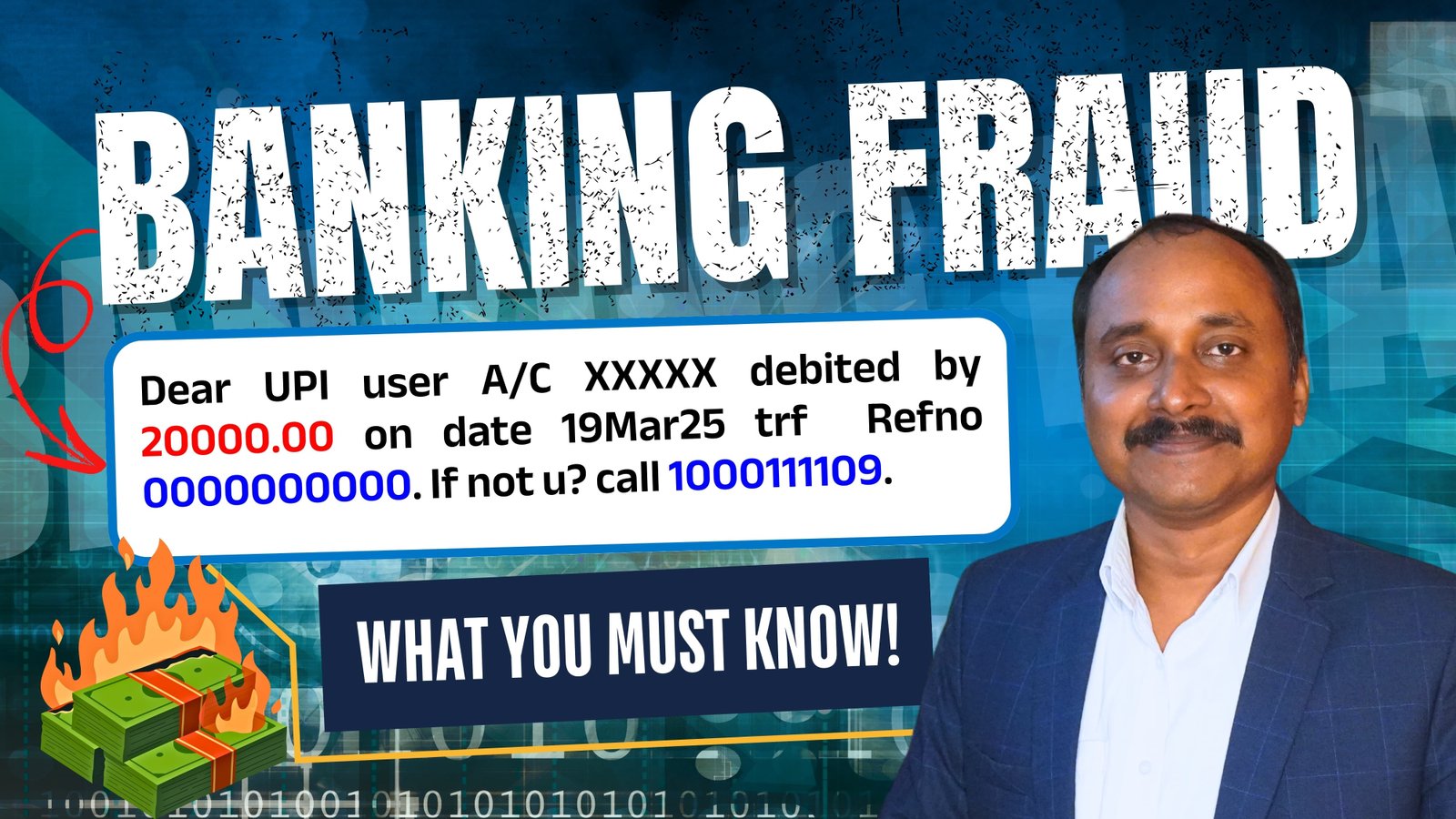

Banking fraud, Credit card fraud, investment fraud, online money fraud, credit card issues hampering public daily life.

Goutam Paul ON BANKING FRAUDS: Nowadays, it has been increasing a large number of banking frauds.

Today we are showing an overview of three categorically explanations of preventing banking fraud in India, one is Technical Measures to Prevent Banking Fraud, two, Non Technical Measures to Prevent Banking Fraud,

and three Legal Measures to Prevent Banking Fraud.

1. Technical Measures to Prevent Banking Fraud

* Strong Passwords and MFA:

* Using strong, unique passwords (combination of uppercase, lowercase, numbers, and symbols) for online banking accounts is crucial. Implementing Multi-Factor Authentication (MFA) adds an extra layer of security by requiring multiple forms of verification (e.g., passwords, biometrics, one-time codes).

* Keeping operating systems, browsers, and antivirus software updated is essential to patch security vulnerabilities that hackers can exploit.

* Beware of Phishing:

Be vigilant about phishing attempts, which are fraudulent emails, messages, or calls designed to trick you into revealing personal or financial information. Never click on suspicious links or download attachments from unknown senders.

* Avoid using public Wi-Fi networks for online banking transactions. Public Wi-Fi networks are often unsecured, making them vulnerable to eavesdropping.Use a Virtual Private Network (VPN) for added security when using public Wi-Fi.

* Install and regularly update antivirus and anti-malware software on all devices used for online banking.

* Utilize biometric authentication features like fingerprint or facial recognition for added security when accessing online banking accounts.

* Secure Browsing:

Use a secure web browser (like Chrome or Firefox) with built-in security features like phishing protection and ad blockers.

* AI-Powered Fraud Detection:

Banks are increasingly utilizing AI and machine learning algorithms to analyze transaction patterns, identify anomalies, and detect fraudulent activity in real-time.

* Blockchain Technology:

Blockchain technology is being explored for secure and transparent financial transactions, reducing the risk of fraud.

* Behavioral Biometrics:

Going beyond fingerprints and facial recognition, behavioral biometrics analyzes typing patterns, mouse movements, and other behavioral cues to identify and authenticate users.

Non-Technical Measures

* Monitor Bank Accounts Regularly: Review your bank statements regularly for any unauthorized transactions and report any discrepancies immediately.

* Shred Sensitive Documents: Properly dispose of bank statements, credit card slips, and other documents containing sensitive information by shredding them before discarding.

* Be Cautious of Social Engineering: Be wary of social engineering tactics, such as phone calls, emails, or text messages from individuals posing as bank representatives. Never share your personal or financial information with anyone unless you are absolutely certain of their identity and the legitimacy of their request.

* Limit Sharing of Personal Information: Be mindful of the information you share online, especially on social media platforms. Avoid sharing sensitive information like your date of birth, account numbers, and Social Security numbers.

* Beware of Skimming Devices: Be vigilant when using ATMs. Check for any signs of tampering, such as loose card readers or hidden cameras.

While open banking offers convenience, Banks are working to ensure that open banking platforms are secure and resistant to fraud.

* Enable Security Alerts: Sign up for email or SMS alerts from your bank to receive notifications about account activity, such as withdrawals, transfers, and login attempts.

Legal Measures to Prevent Banking Fraud

incorporating relevant sections of the Bharatiya Nyaya Sanhita and focusing on the latest updates.

1. Understanding Banking Fraud

Banking fraud encompasses a wide range of illegal activities aimed at defrauding banks and financial institutions. This includes activities like:

* Check Fraud: Forging or altering checks to obtain unauthorized funds.

* Credit Card Fraud: Unauthorized use of credit cards, including identity theft and online fraud.

* ATM/Debit Card Fraud: Skimming, card cloning, and unauthorized withdrawals from ATMs.

* Loan Fraud: Obtaining loans through false representations or fraudulent documents.

* Online Banking Fraud: Phishing, hacking, and malware attacks targeting online banking accounts.

* Money Laundering: Concealing the origin of illegally obtained funds.

* Legal Framework:

* Bharatiya Nyaya Sanhita. This comprehensive criminal code in India contains provisions related to various forms of banking fraud. Relevant sections include:

Legal Framework:

Under BNS sections are : 338 BNS. 318(4), 111 & 238.

* Section 467: Forgery of valuable security / 338 BNS.

* Section 468: Forgery for the purpose of cheating.

* Section 471: Using as genuine a forged document.same as BNS.

* Section 477A: Fraudulent banking.

BNS Section 318(4), 111 & 238.

* Information Technology Act, 2000: This Act addresses cybercrimes, including online banking fraud, hacking, and data theft.

* Prevention of Money Laundering Act (PMLA): This Act deals with the prevention and control of money laundering, which is often linked to banking fraud.

* Report Suspicious Activity: Report any suspicious activity to your bank or the relevant authorities immediately.

Firstly, Reporting banking fraud in India is 1930.

Disclaimer: This information is for general guidance only and should not be construed as one's particulars need. You can take expert advice as your requirment.